In this blog post, we will explore the difference between FA G/L journal and FA journal in Business Central, two types of journals that are used to record fixed asset transactions. We will also look at some scenarios where you might use one or the other, and how they affect the fixed asset ledger and the general ledger.

What is FA G/L journal?

FA G/L journal is a journal that posts transactions to both the fixed asset ledger and the general ledger. This means that any changes in the value or depreciation of a fixed asset will be reflected in both ledgers. For example, if you purchase a new fixed asset, you can use the FA G/L journal to record the acquisition cost and the corresponding increase in the fixed asset account and the cash account in the general ledger. Similarly, if you dispose of a fixed asset, you can use the FA G/L journal to record the disposal value and the corresponding decrease in the fixed asset account and the gain or loss account in the general ledger.

Screenshot 1

Screenshot 2

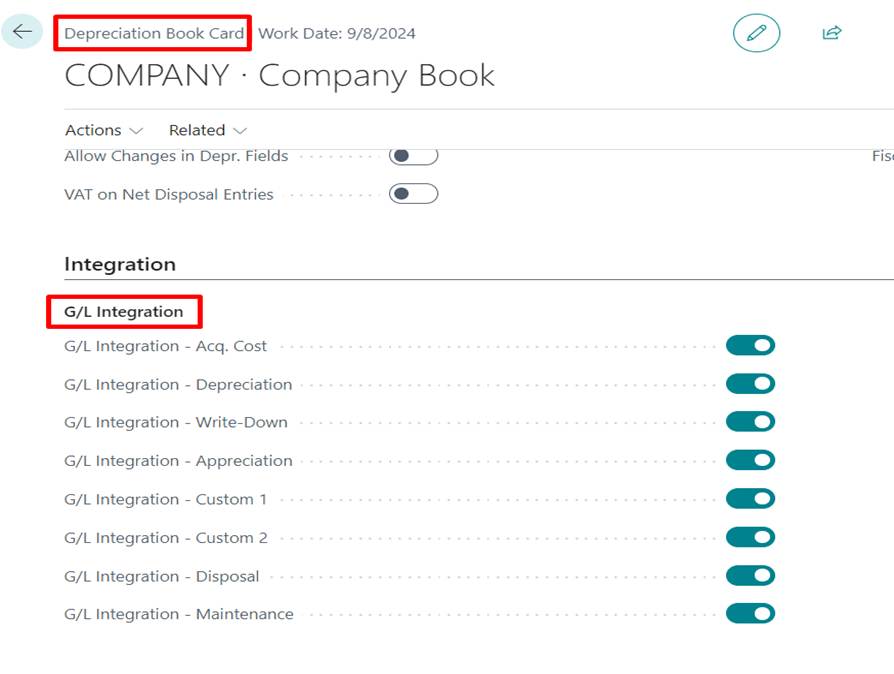

To use the FA G/L journal, you must enable the integration between fixed asset and general ledger on the depreciation book card (refer to the Screenshot 3). This means that you have to specify which general ledger accounts are used for each fixed asset posting type, such as acquisition cost, depreciation expense, accumulated depreciation, disposal value, etc. You can also set up default accounts for each fixed asset class or subclass, or for each individual fixed asset.

Screenshot 3

What is FA journal?

FA journal is a journal that posts transactions to only the fixed asset ledger. This means that any changes in the value or depreciation of a fixed asset will not be reflected in the general ledger. For example, if you purchase a new fixed asset, you can use the FA journal to record the acquisition cost and update the fixed asset ledger, but you will have to manually record a corresponding entry in the general ledger to increase the fixed asset account and decrease the cash account. Similarly, if you dispose of a fixed asset, you can use the FA journal to record the disposal value and update the fixed asset ledger, but you will have to manually record a corresponding entry in the general ledger to decrease the fixed asset account and recognize the gain or loss.

To use the FA journal, you do not need to enable the integration between fixed asset and general ledger (please refer to the below screenshot) on the depreciation book card. This means that you do not have to specify any general ledger accounts for each fixed asset posting type. You can still set up default accounts for each fixed asset class or subclass, or for each individual fixed asset, but they will only be used for reporting purposes.

Screenshot 4

Screenshot 5

When to use FA G/L journal or FA journal?

The choice between FA G/L journal and FA journal depends on your business needs and preferences. Some factors that might influence your decision are:

– The level of automation and accuracy that you want for your fixed asset accounting. Using FA G/L journal will ensure that your fixed asset ledger and general ledger are always in sync and consistent, while using FA journal will require manual entries and adjustments in the general ledger.

– The level of detail and flexibility that you want for your fixed asset reporting. Using FA G/L journal will allow you to track and analyse each fixed asset transaction in both ledgers, while using FA journal will only show you the net changes in the fixed asset ledger.

– The number and frequency of fixed asset transactions that you have. Using FA G/L journal might be more efficient and convenient if you have many or frequent transactions, while using FA journal might be simpler and faster if you have few or infrequent transactions.

In summary, FA G/L journal and FA journal are two different ways of recording fixed asset transactions in Business Central. They have different effects on the fixed asset ledger and the general ledger, and they have different advantages and disadvantages depending on your business needs and preferences. You should choose the one that suits your situation best.

Leave a comment